Fortitude Financial Group Things To Know Before You Buy

Fortitude Financial Group Things To Know Before You Buy

Blog Article

Getting The Fortitude Financial Group To Work

Table of ContentsThe Ultimate Guide To Fortitude Financial GroupMore About Fortitude Financial GroupFortitude Financial Group Fundamentals ExplainedThe smart Trick of Fortitude Financial Group That Nobody is Discussing

With the best strategy in position, your cash can go even more to assist the organizations whose goals are aligned with your values. A monetary advisor can aid you specify your philanthropic providing goals and integrate them into your monetary strategy. They can likewise encourage you in ideal methods to optimize your providing and tax obligation deductions.If your organization is a collaboration, you will desire to go with the succession planning process together - St. Petersburg, FL, Financial Advising Service. An economic expert can help you and your companions recognize the crucial elements in company sequence preparation, figure out the worth of business, develop investor agreements, establish a payment framework for successors, overview transition options, and far more

The secret is finding the right economic expert for your circumstance; you may finish up appealing different experts at various stages of your life. Attempt calling your economic organization for recommendations.

Your next step is to talk with a qualified, certified expert who can provide recommendations tailored to your specific scenarios. Nothing in this post, neither in any kind of connected resources, ought to be understood as economic or legal suggestions. While we have made good belief initiatives to make certain that the details provided was right as of the date the web content was prepared, we are incapable to ensure that it stays exact today.

Facts About Fortitude Financial Group Uncovered

Financial advisors help you choose about what to do with your cash. They assist their customers on conserving for significant acquisitions, placing cash apart for retired life, and investing money for the future. They can also encourage on current financial and market task. Let's take a closer look at exactly what a monetary consultant does.

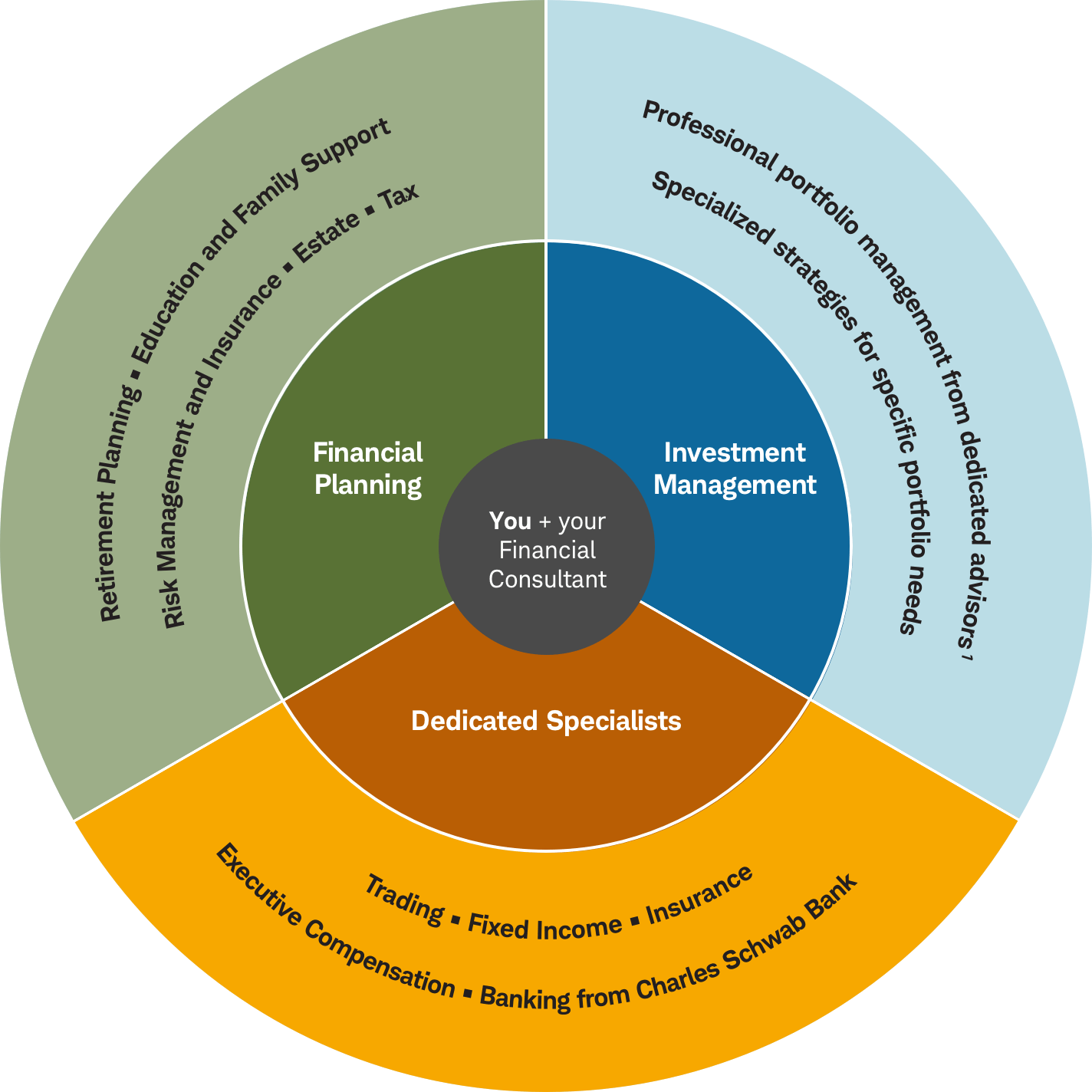

Advisors use their expertise and competence to construct tailored economic plans that intend to accomplish the financial objectives of clients (https://www.metal-archives.com/users/fortitudefg1). These plans consist of not only investments however likewise savings, budget, insurance, and tax strategies. Advisors better sign in with their clients often to re-evaluate their current scenario and plan appropriately

The Fortitude Financial Group Ideas

To achieve your objectives, you may need a knowledgeable specialist with the right licenses to assist make these strategies a fact; this is where an economic expert comes in. With each other, you and your expert will certainly cover several subjects, consisting of the amount of money you need to save, the types of accounts you require, the kinds of insurance you should have (consisting of lasting care, term life, impairment, and so on), and estate and tax planning.

Financial advisors offer a range of solutions to customers, whether that's giving reliable basic financial investment advice or assisting within an economic objective like purchasing a college education and learning fund. Below, find a list of the most common solutions given by economic advisors.: A financial advisor supplies recommendations on investments that fit your design, goals, and risk tolerance, developing and adjusting spending technique as needed.: A financial expert develops methods to aid you pay your financial debt and prevent debt in the future.: An economic consultant offers pointers and approaches to develop budget plans that aid you meet your objectives in the brief and the lengthy term.: Component of a budgeting approach may include approaches that assist you pay for greater education.: Likewise, an economic consultant develops a saving strategy crafted to your specific demands as you head right into retirement. https://www.provenexpert.com/fortitude-financial-group3/.: A monetary consultant assists you recognize individuals or companies you wish to obtain your heritage after you pass away and develops a plan to perform your wishes.: An economic advisor gives you with the best lasting remedies and insurance choices that fit your budget.: When it involves taxes, a financial expert might assist you prepare tax obligation returns, optimize tax obligation deductions so you get one of the most out of the system, schedule tax-loss gathering protection sales, make certain the finest use the resources gains tax rates, or plan to lessen tax obligations in retired life

On the questionnaire, you will likewise show future pension plans and revenue resources, project retired life needs, and describe any type of long-lasting financial responsibilities. In brief, you'll note all existing and expected investments, pensions, presents, and incomes. The investing element of the questionnaire touches upon more subjective topics, such as your danger resistance and threat ability.

The Fortitude Financial Group Diaries

Now, you'll also allow your advisor understand your financial investment choices too. The initial assessment might likewise include an examination of other financial administration topics, such as insurance Related Site coverage problems and your tax situation. The expert needs to be aware of your existing estate plan, as well as various other experts on your preparation group, such as accountants and legal representatives.

Report this page